Oct 21, 2022

Inflation has hit organic fresh produce in third quarter

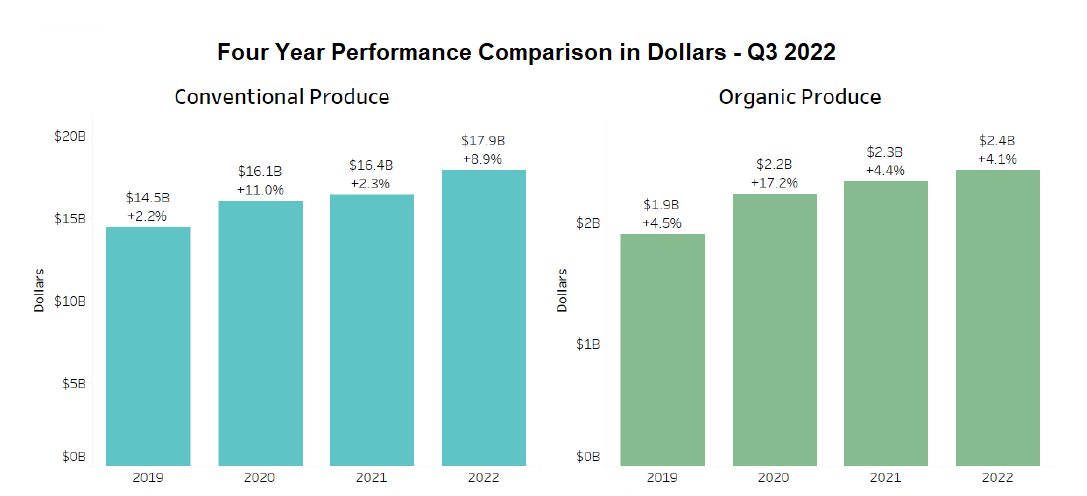

Ongoing inflation resulted in higher retail prices of organic fresh produce during third quarter 2022, generating a 4.1% increase in total organic dollars but also contributing to a decline of 4.5% in organic volume compared to the same period last year.

This is according to the Q3 2022 Organic Produce Performance Report released by Organic Produce Network (OPN) and Category Partners.

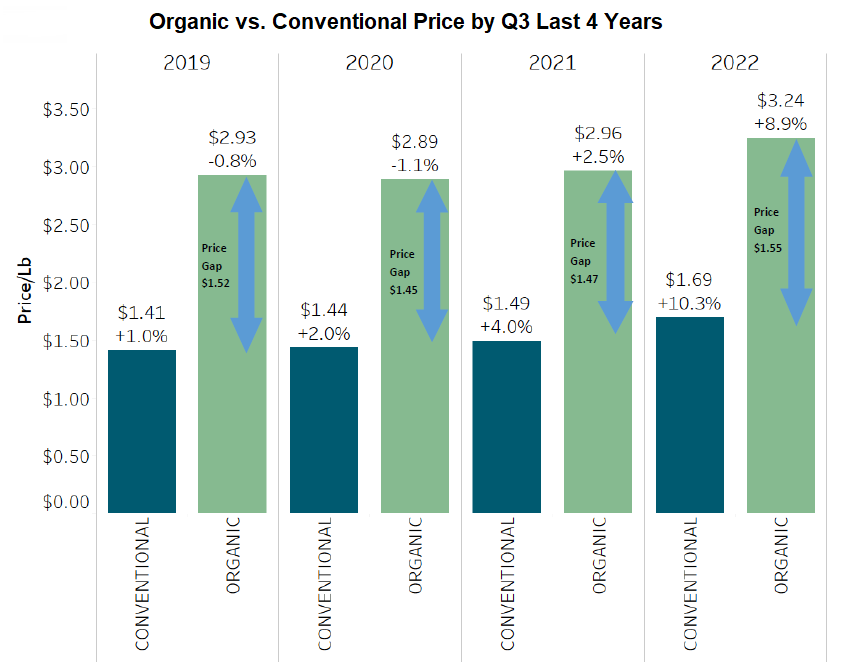

Overall, organic fresh produce pricing per pound increased by 8.9% for Q3 2022 compared to the same period last year, with quarterly sales topping $2.4 billion. At the same time, conventional produce’s average price per pound increased by more than 10%, with total sales of $17.93 billion. In total, overall produce department sales gained 8.3% in dollars for the third quarter of 2022, while volume declined by 1.55. The average price per pound increased by 21 cents for the total produce department compared to Q3 2021.

The Q3 2022 Organic Produce Performance Report uses Nielsen IQ syndicated data to track and report the performance of organic fresh produce, and specifically the top 20 leading organic categories. The report suggests that the rising prices might cause consumers to be more selective in their organic shopping.

“Comparing the third quarter of this year to third quarters of the past three years shows organic volume declining—and more than three percentage higher than the decline in conventional produce volume for Q3 of 2022,” said Tom Barnes, CEO of Category Partners. “Conventional produce outperformed organic produce in dollar growth, suggesting price increases in conventional produce have been more easily absorbed by consumers than the higher prices in organics.”

Organic apples and lettuce were examples of product substitution from organic to conventional by consumers as their price per pound of organic increased by more than double the amount of conventional. This resulted in a volume decline as high as 15%.

A bright spot for organic sales in Q3 of this year was the tomato category, which saw an impressive 19% increase in volume and a staggering 30 percent increase in dollars. In total, 14 of the top categories posted year-over-year increases in dollars, with potatoes, onions, and peaches showing double-digit gains. Conversely, apples posted the largest decline in dollar sales, with lettuce and bell peppers also showing noticeable declines.

Berries and packaged salads continue to be the top two organic produce categories, responsible for nearly 40% of all organic produce dollars.

While organic prices in aggregate remain substantially higher than conventional (by $1.55 per pound in Q3 2022), the average price of both conventional and organic produce has increased. When compared to Q3 of last year, organic pricing per pound has risen 8.9% while conventional pricing has risen 10.3 percent. “In Q3 2022, the average price gap between conventional and organics is the largest it has been in the last four years,” said Barnes. “In this inflationary time period, it will be important for organic suppliers to understand how their pricing impacts substitution behavior among various consumer demographics.”

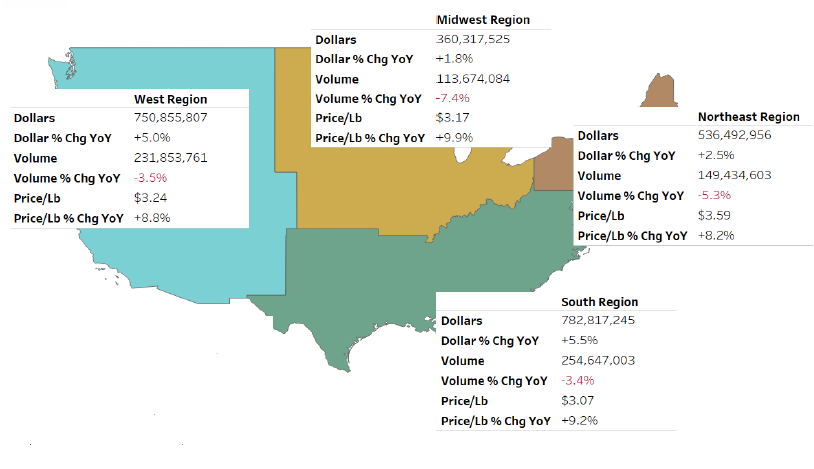

Geographically, all four regions of the U.S. showed consistent organic performance where dollars grew and volume declined. The Midwest saw the lowest dollar growth (1.8%) and highest volume decline (–7.4%), and it was the region with the highest price per pound increase (9.9%). Consistent with previous reports, the South continued to show the most improvement year over year in sales dollars for the quarter (5.5%).

Despite the minor decline in volume across the country, OPN co-founder and CEO Matt Seeley is positive on the long-term prospects for growth of organic fresh produce. “Inflation and supply chain challenges have impacted pricing in the short term; however, organic fresh produce will remain an important component of weekly food shopping as consumers look for healthy, safe and nutritious products for their families,” he said.