Aug 3, 2022

Organic fresh produce sees inflation in 2nd quarter

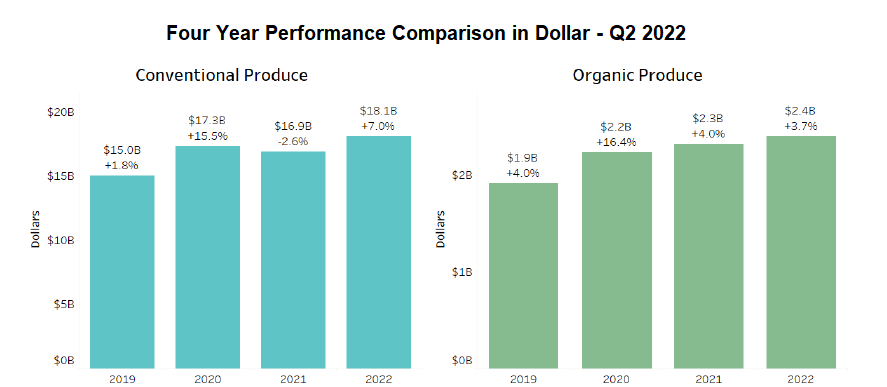

Higher retail prices of organic fresh produce during the second quarter of 2022 generated a 3.7% increase in total organic dollars but also contributed to a decline in organic volume of 2.8%, according to the Q2 2022 Organic Produce Performance Report issued by the Organic Produce Network (OPN) and Category Partners.

Overall, organic fresh produce pricing increased by 6.7% for the 2nd quarter compared to same period last year, with sales for the quarter topping $2.4 billion. At the same time, conventional produce’s average price increased by more than 9% compared to the same period last year, with total sales of $18.1 billion. The Q2 2022 Organic Produce Performance Report uses Nielsen IQ syndicated data to track and report the performance of organic fresh produce — and specifically the top 20 leading organic categories.

The report suggests consumers are watching grocery spending carefully as inflation often takes its toll on higher priced items, which would include many organic fresh produce items. “Seeing a decline in organic volume for Q2 suggests food budgets are under stress in many U.S. households,” said Tom Barnes, CEO of Category Partners. “It’s common to see budget-centric consumers trade down, substituting for lower-priced conventional items or shifting from a high-priced organic item to a cheaper organic alternative from another category.”

Barnes believes organic substitution explains why organic bananas had a particularly strong quarter in Q2. “Bananas are one of the lowest-priced organic fruits and have the smallest price spread between conventional and organic. For the quarter, while nearly every other organic fruit declined in volume, bananas increased in both dollars (+4.3%) and volume (+4.0%). So for budget-focused consumers still wanting to buy organic, bananas provided a cost-effective option. Suppliers need to be aware of shifting consumer purchase drivers and develop strategies to keep shoppers buying,” he said.

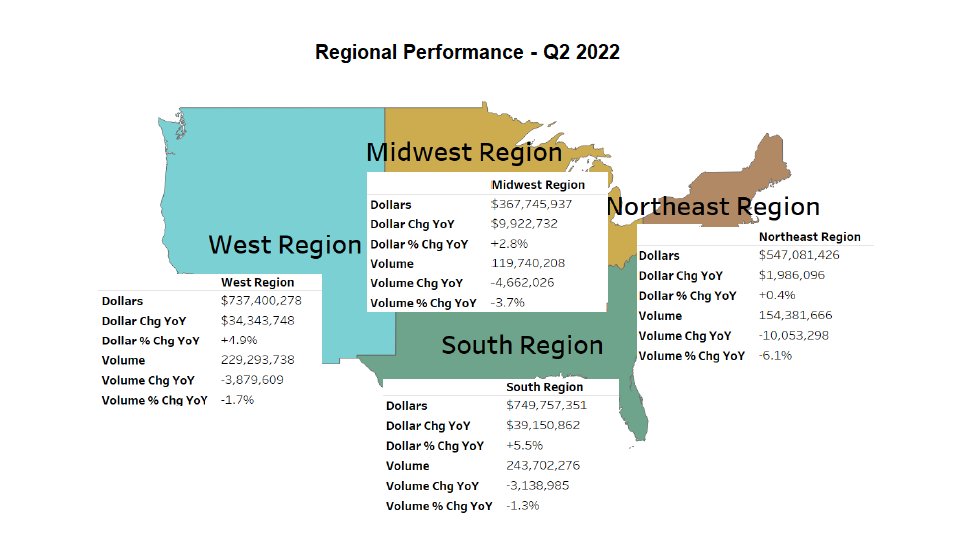

Geographically, all four regions of the U.S. showed increases in sales and decreases in volume for the quarter. Organic performance during Q2/2022 was weakest in the Northeast, where dollars increased by a mere 0.4%, and volume fell by 6.1%. The South continues to show the most improvement year over year, and with a fairly low ACV compared to the Northeast and West, data suggests the South is poised for continued growth.

Despite the minor decline in volume, OPN Co-founder and CEO Matt Seeley is bullish on the long-term prospects for growth of organic fresh produce. “While there are likely some difficult months ahead, the long-term potential for continued organic fresh produce growth remains unchanged,” Seeley said. “Inflation and supply chain challenges have impacted pricing in the short term; however, organic fresh produce will remain an important component of weekly food shopping as consumers look for healthy, safe, and nutritious products for their families.”

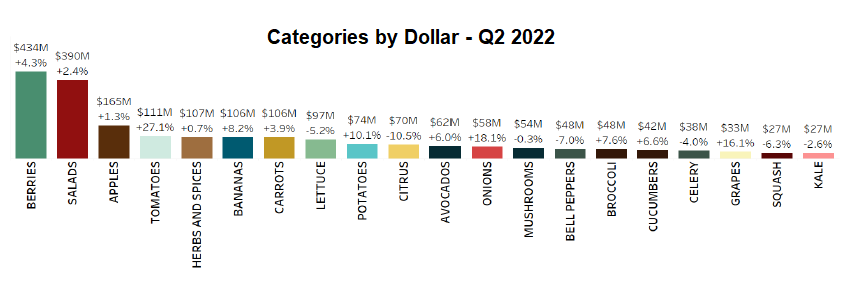

In addition to bananas having an exceptional quarter, the berry category (strawberries, blueberries, raspberries, and blackberries) led the way in dollar sales, topping $430 million. Organic blackberries generated the largest percent increase in dollars, gaining 27.6% year over year, followed by tomatoes, onions, and raspberries.

Conversely, blueberries posted the largest decline in dollars, with bell peppers and squash also showing noticeable declines. Berries and salads continue to be the top organic produce categories by total sales, responsible for nearly 40 percent of all organic produce dollars.

The Q2 2022 Organic Produce Performance Report covers total food sales in the U.S., including all outlets (i.e. supermarkets, mass merchandisers, club stores, dollar stores, convenience stores and military commissaries), over the months of April, May and June of this year. The full report is available on the Organic Produce Network website.