Sep 17, 2024

Fruit, vegetable and nut exports help balance U.S. ag export deficit

Exports of fruits, nuts, vegetables and potatoes are helping balance losses in other ag export sectors in the expanding overall U.S. agricultural trade deficit and are predicted to hit record levels, according to the latest U.S. Department of Agriculture numbers.

Horticultural product exports, including apples, grapes, wine and nuts, are predicted to hit record levels.

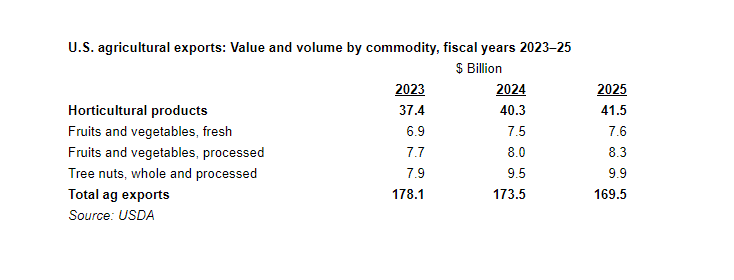

The report, released in late August, forecasts U.S. FY 2025 agricultural exports at $169.5 billion and imports at $212 billion.

For FY 2024, ag exports are predicted at $173.5 billion, up $3 billion from the May projection, due to higher horticultural and grain exports.

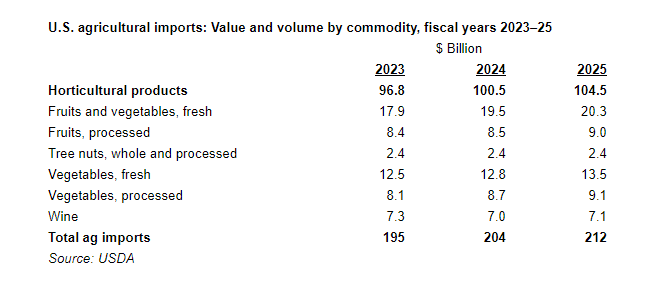

FY 2025 agricultural imports are estimated to be $8 billion higher than previous estimates, following rising imports of horticultural as well as sugar and tropical products, according to the report.

In 2025, horticultural product exports are expected for a record $41.5 billion, up $1.2 billion from

2024.

Fresh fruits and vegetables are forecast $100 million higher to $7.6 billion due partly to rising apple shipments to India following last year’s lifting of retaliatory tariffs that had been in place since 2019.

Processed fruits and vegetables are predicted $300 million higher to $8.3 billion on rising exports to Canada, Mexico and Europe.

The FY 2024 estimate for horticultural products jumped $1.3 billion to $40.3 billion. Fresh fruits and vegetables are $400 million higher to $7.5 billion. Stronger strawberry shipments to Canada helped boost processed fruit and vegetables $300 million to $8 billion.

Japan and South Korea exports fell following weaker corn prices and lower beef volumes, but were partially offset by strong demand for fresh fruits.

India’s export forecast increased while lower cotton export values to Pakistan kept South Asia’s track unchanged, balanced by apple and tree nut demand.

EU exports remain unchanged, despite lower soybean value, offset by robust tree nut and other horticultural product demand.

In the Western Hemisphere, where Mexico and Canada are the largest U.S. ag trade partners, higher prospects for horticultural products balance out lower exports of beef.

Growing imports

FY 2025 horticultural imports are 4% higher over the previous year, with fresh fruits the largest component, growing by $800 million or 4% to $20.3 billion. Fresh fruit import volumes and processed fruit import values are projected higher in part due to improved Mexico and South America growing conditions.

Fresh vegetable imports expect to expand by $700 million or 5% in 2025 to $13.5 billion. Processed vegetables are predicted to grow $400 million to $9.1 billion. Frozen french fries are a major import and Canada’s large potato stock coupled with relatively low prices are expected to facilitate another strong year of imports.

FY 2024 imports from Mexico increased $100 million, 7% from 2023. Horticultural products, particularly fresh produce including tomatoes, citrus and avocados as well as processed food and beverages, represent a significant share of the growth.

FY 2025 imports from Canada are projected to be $42.1 billion, 3% higher than 2024. Canada’s crop production is expected to be broadly favorable, providing ample supply for FY 2025 exports of grains, oilseeds and horticultural crops including potatoes. This should facilitate continued growth of prepared fruit and vegetables exports, as well as other processed foods, according to the USDA.

The FY 2024 imports forecast for South America to the U.S. was raised by $400 million, with U.S. imports expected to grow 8% over 2023. Imports from Chile are 16% higher than 2023, regaining the import value lost in 2023, due to strong fruit and preparation imports, especially grapes, in the last quarter. Argentina has increased due to improving economic conditions facilitating a range of U.S. imports especially beef, fruits and juices.